Have you ever wished you could go back in time to test your trading strategy before risking your hard-earned money? Well, that’s essentially what backtesting software lets you do—minus the time travel part! Backtesting has become a game-changer for traders, allowing them to simulate trades based on past data and see how their strategies would have performed in real-world conditions.

But here’s the thing—backtesting isn’t just for professional traders or Wall Street wizards. Even if you’re new to trading, these tools can give you valuable insights, showing you what works and what doesn’t before you ever place a trade. Imagine knowing that your strategy is backed by real data, not just gut feelings. Sounds pretty reassuring, right?

In this guide, we’re going to explore backtesting software from a fresh perspective—breaking it down for beginners who want to step up their trading game. You’ll learn what backtesting really is, why it’s crucial, and how to pick the right software for your needs. So, let’s dive in and discover how you can use these tools to make smarter, data-driven trading decisions.

What is Backtesting Software?

Backtesting software is like a crystal ball for traders, but one that’s based on facts and data instead of fortune-telling. Essentially, it allows you to test a trading strategy by applying it to historical market data. The goal? To see how well the strategy would have worked if you’d used it in the past. It’s like giving your trading idea a trial run without any of the risks.

The software takes into account every detail of the market—prices, trends, patterns—and runs your strategy through it, showing you how it would have performed under different market conditions. Some traders use it to fine-tune existing strategies, while others create entirely new ones, based on what the data reveals.

The beauty of backtesting is that it provides a safe space to experiment and learn. You can test ideas, tweak strategies, and get feedback instantly. In the world of trading, where every decision counts, this is a huge advantage. With backtesting software, you’re not just guessing—you’re making informed, data-backed decisions.

Why is Backtesting Important for Traders?

Backtesting isn’t just a tool—it’s a critical process for any trader looking to build a reliable strategy. Here’s why it’s so important:

Minimizing Risk with Data-Driven Decisions

Backtesting lets you make informed decisions before putting real money on the line. Here’s how it helps reduce risk:

- Simulates trades based on historical data, so you can evaluate your strategy’s past performance.

- Identifies weak spots by revealing how your strategy reacts under different market conditions.

- Adjusts parameters as needed, allowing you to refine your approach without financial consequences.

- Offers performance metrics, such as profit ratios, drawdowns, and win/loss percentages, giving you a full picture of your strategy’s reliability.

Building Confidence in Your Strategy

The confidence to trade comes from knowing your strategy is backed by real data, not just guesswork. Here’s why backtesting helps build that confidence:

- Provides validation by showing that your strategy worked in past market environments.

- Reduces emotional decision-making, as you have data to rely on rather than gut feelings.

- Improves trading discipline by teaching you when to stick with your strategy and when to adjust based on market conditions.

Also Read: How to Get Started with Quant Computer Science

Learning from Mistakes Without the Financial Loss

One of the best aspects of backtesting is the ability to learn from mistakes without any real-world consequences. Here’s how you benefit:

- Test strategies in a risk-free environment, allowing you to fail without financial loss.

- Experiment with different variables like entry and exit points to see how they impact performance.

- Identify and correct flaws before they cost you money in live trading.

- Accelerate your learning curve by allowing you to try, fail, and improve—all with historical data.

Key Features to Look for in Backtesting Software

Not all backtesting software is created equal. Whether you’re just starting out or you’ve been trading for a while, there are some essential features you should look for to get the most out of your backtesting experience. These tools should not only help you test strategies but also provide the flexibility and insights you need to make better trading decisions.

Historical Data Access

The quality of backtesting depends heavily on the data you use. The more comprehensive and accurate the historical data, the better you can assess how your strategy would have performed in different market conditions. Here are some key points to consider:

- Access to long-term historical data: Look for software that offers extensive market data over multiple years, so you can test your strategy across different market cycles.

- Diverse asset classes: Make sure the software supports the specific assets you trade, whether it’s stocks, forex, commodities, or cryptocurrencies.

- Realistic data: The closer the data reflects actual market conditions (like slippage, spreads, and commissions), the more reliable your backtest results will be.

Customizable Strategy Parameters

Every trader has a unique approach, and your backtesting software should let you customize your strategies to match your trading style. Here’s what to look for:

- Flexible entry and exit rules: The software should allow you to set specific buy/sell criteria, whether it’s based on indicators, price action, or market trends.

- Adjustable variables: You should be able to tweak factors like stop-loss, take-profit levels, and position sizing to see how changes impact performance.

- Multiple timeframes: Being able to test strategies on different timeframes (daily, weekly, intraday) can give you a broader view of its performance.

Performance Metrics

Backtesting is only as valuable as the insights it provides. The right software will offer a detailed breakdown of your strategy’s performance, helping you understand both its strengths and weaknesses. Look for:

- Key performance indicators (KPIs): Metrics like win/loss ratio, average return, drawdowns, and Sharpe ratio can give you a full picture of how well your strategy performs.

- Risk analysis tools: These tools help you evaluate the potential risk of a strategy by measuring volatility and downside risk.

- Profit and loss simulations: This feature allows you to see how much profit you would have made—or lost—during the backtest period.

Realistic Trading Conditions

Backtesting is most effective when it mirrors real-world trading as closely as possible. A few must-have features in this regard include:

- Commission and fee simulation: Make sure the software takes into account trading fees, spreads, and slippage to give you realistic results.

- Liquidity considerations: Some platforms factor in liquidity, ensuring that your backtest doesn’t assume trades at unrealistic prices or volumes.

- Real-time simulation: Some advanced backtesting software offers “real-time” simulation, which allows you to forward-test your strategy on live data without executing actual trades.

User-Friendly Interface and Support

Backtesting software can be complex, but that doesn’t mean it should be difficult to use. Here are a few things to look for in terms of usability:

- Intuitive design: Look for software with a user-friendly interface that’s easy to navigate, even if you’re new to trading.

- Educational resources: Platforms that offer tutorials, guides, and community support can be invaluable, especially for beginners.

- Automation capabilities: Some software allows you to automate parts of the backtesting process, such as running multiple strategies simultaneously or auto-optimizing variables.

How to Use Backtesting Software: Step-by-Step Guide

Using backtesting software might seem complex, but it’s pretty simple once you break it down. Follow these steps to get started with testing your trading strategy.

Step 1: Define Your Trading Strategy

Before using the software, know the rules for your trades:

- Entry points: When will you buy?

- Exit points: When will you sell?

- Risk management: How much of your capital will you risk per trade?

Step 2: Choose Historical Data

Pick the market data you want to test your strategy on:

- Time period: Select a date range that covers different market conditions (up, down, sideways).

- Asset type: Choose the asset you’re trading, like stocks, forex, or cryptocurrencies.

Step 3: Input Your Strategy

Enter your strategy’s details into the software:

- Buy/sell signals: What triggers a trade (e.g., price patterns, technical indicators)?

- Stop-loss/take-profit: Define how you’ll exit a trade to manage risk and capture profit.

- Position size: Set how much money you’re putting into each trade.

Step 4: Run the Backtest

Click “run” to test your strategy:

- Test in different scenarios: Try different timeframes or market conditions.

- Check performance metrics: Look at profit, loss, win rate, and drawdowns to see how well your strategy performed.

Step 5: Analyze the Results

Review the backtest data to evaluate your strategy:

- Win rate: How often does the strategy make a profit?

- Average profit/loss: What’s the typical gain or loss per trade?

- Drawdown: What’s the biggest loss your strategy experienced?

Step 6: Refine Your Strategy

If your results aren’t great, tweak the strategy:

- Adjust one thing at a time: Change your stop-loss, entry point, or position size and test again.

- Avoid overfitting: Don’t make your strategy too perfect for past data—this may cause it to fail in live trading.

Step 7: Test in Live Markets (Cautiously)

Once your backtest looks solid:

- Start small: Trade with a small amount of money to see how it performs in real life.

- Keep monitoring: Stay on top of how the strategy works over time and adjust as needed.

Top 7 Backtesting Software Options for Beginners in 2025

If you’re new to trading or backtesting, choosing the right software can feel overwhelming. Here are some of the best backtesting tools that are both powerful and easy to use, making them perfect for beginners.

1. TradingView

Image Source: www.tradingview.com

Why it’s great for beginners: TradingView is widely popular because of its user-friendly interface and access to real-time and historical data. It’s also web-based, so you don’t need to download anything.

- Easy charting tools: You can set up your strategy visually on charts and test it right away.

- Huge community: Learn from other traders by using community-generated scripts and strategies.

- Free version available: TradingView offers a free tier with basic features, perfect for getting started.

2. MetaTrader 4 (MT4)

Image Source: www.metatrader4.com

Why it’s great for beginners: MetaTrader 4 is a staple for forex traders and is widely supported by brokers. It’s known for its simplicity and wide range of tools.

- Customizable strategies: You can easily input trading strategies and run them on historical data.

- Built-in indicators: MT4 has a large library of technical indicators for both backtesting and live trading.

- Demo accounts: You can backtest and forward-test using demo accounts, so you can practice without risking money.

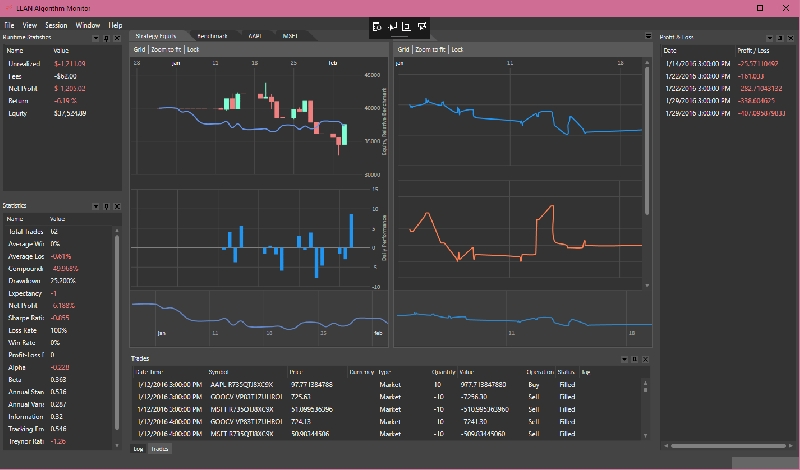

3. NinjaTrader

Image Source: ninjatrader.com/forum

Why it’s great for beginners: NinjaTrader offers a robust backtesting engine along with a user-friendly interface, making it an ideal choice for those looking to trade futures and forex.

- Comprehensive analysis tools: It provides detailed performance metrics after each test, which helps beginners understand strategy performance.

- Free for simulation: NinjaTrader offers a free version that allows you to use backtesting and simulated trading features.

- Customizable with code or templates: Even if you don’t know how to code, you can use pre-made templates or build custom strategies easily.

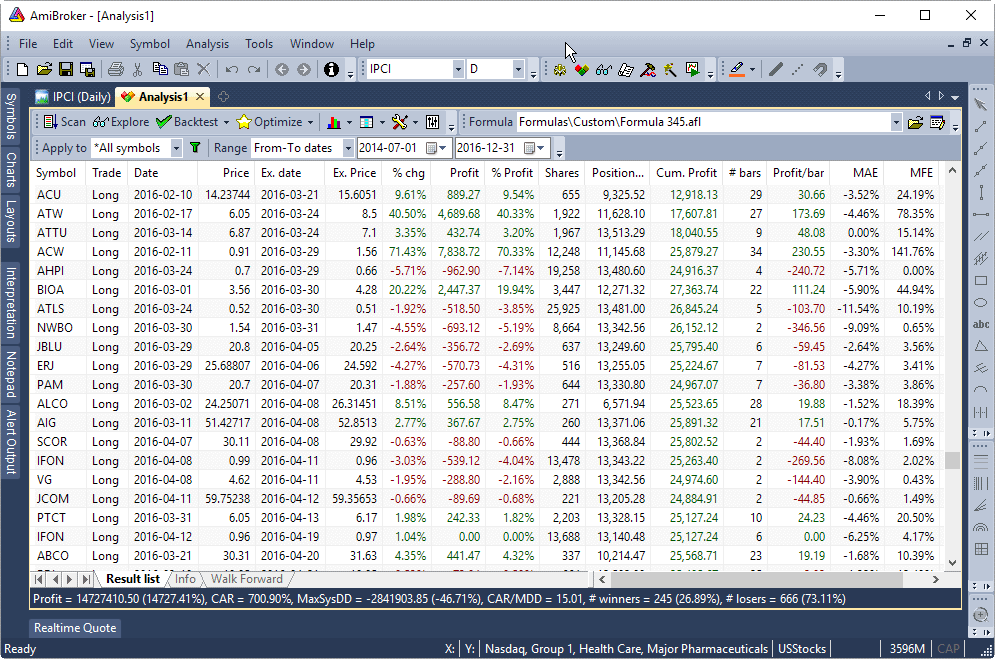

4. Amibroker

Image Source: amibroker.com

Why it’s great for beginners: Amibroker is known for its speed and flexibility. Though slightly more advanced in terms of customization, it offers great value for its price.

- Fast backtesting: Amibroker runs backtests quickly, making it easier for beginners to test multiple strategies without long waits.

- Simple scripting language: You don’t need to be a coding expert; Amibroker’s AFL scripting language is designed for non-programmers.

- Affordable: It’s cost-effective compared to some other paid platforms, especially considering the features it offers.

5. QuantConnect

Image Source: quantconnect.com/forum/discussion

Why it’s great for beginners: QuantConnect is an open-source platform that supports algorithmic trading across a variety of assets, and it’s free to use.

- Cloud-based: No need for downloads—everything runs in the cloud, including backtests.

- Multiple asset classes: You can test strategies on stocks, forex, futures, and even cryptocurrencies.

- Large community and tutorials: The platform offers a lot of learning resources and tutorials, making it easier for beginners to get started.

Also Read: 10 Best Quant Forum to Check this 2024

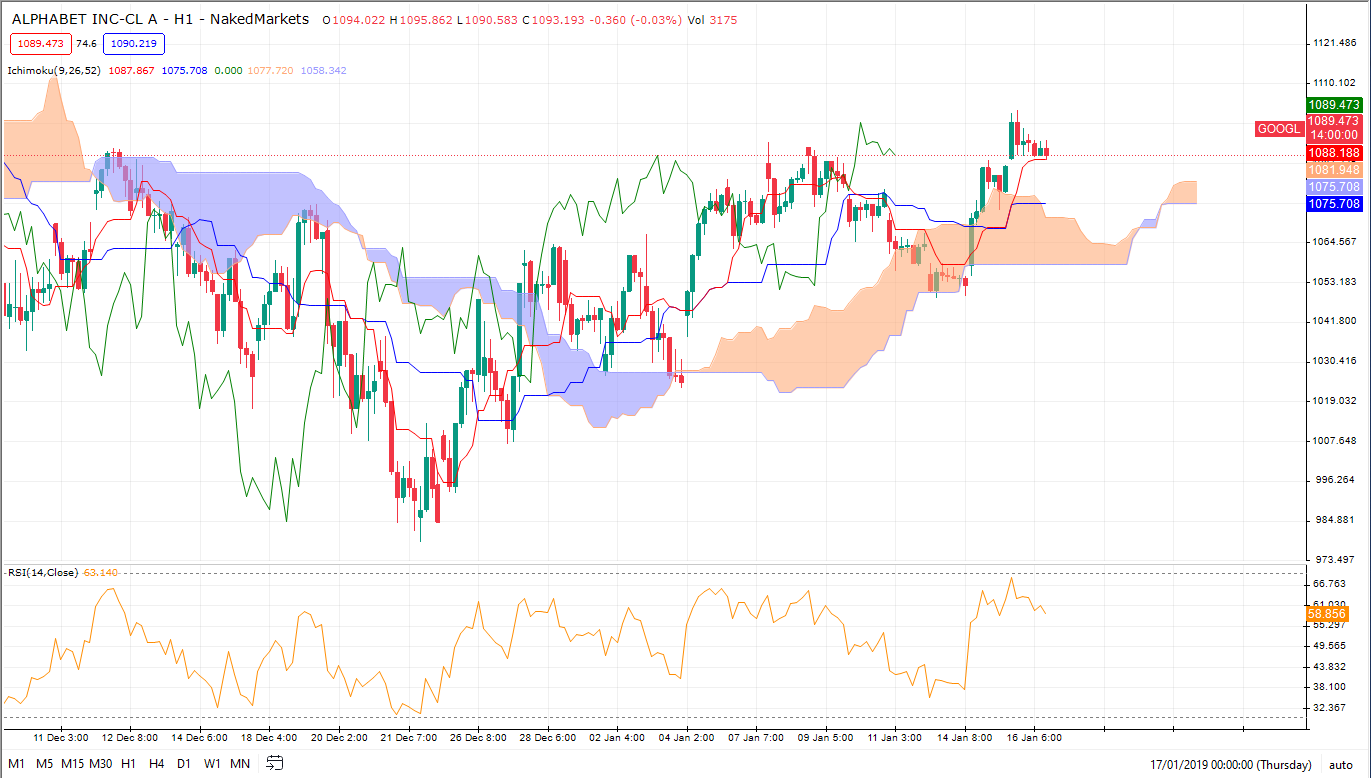

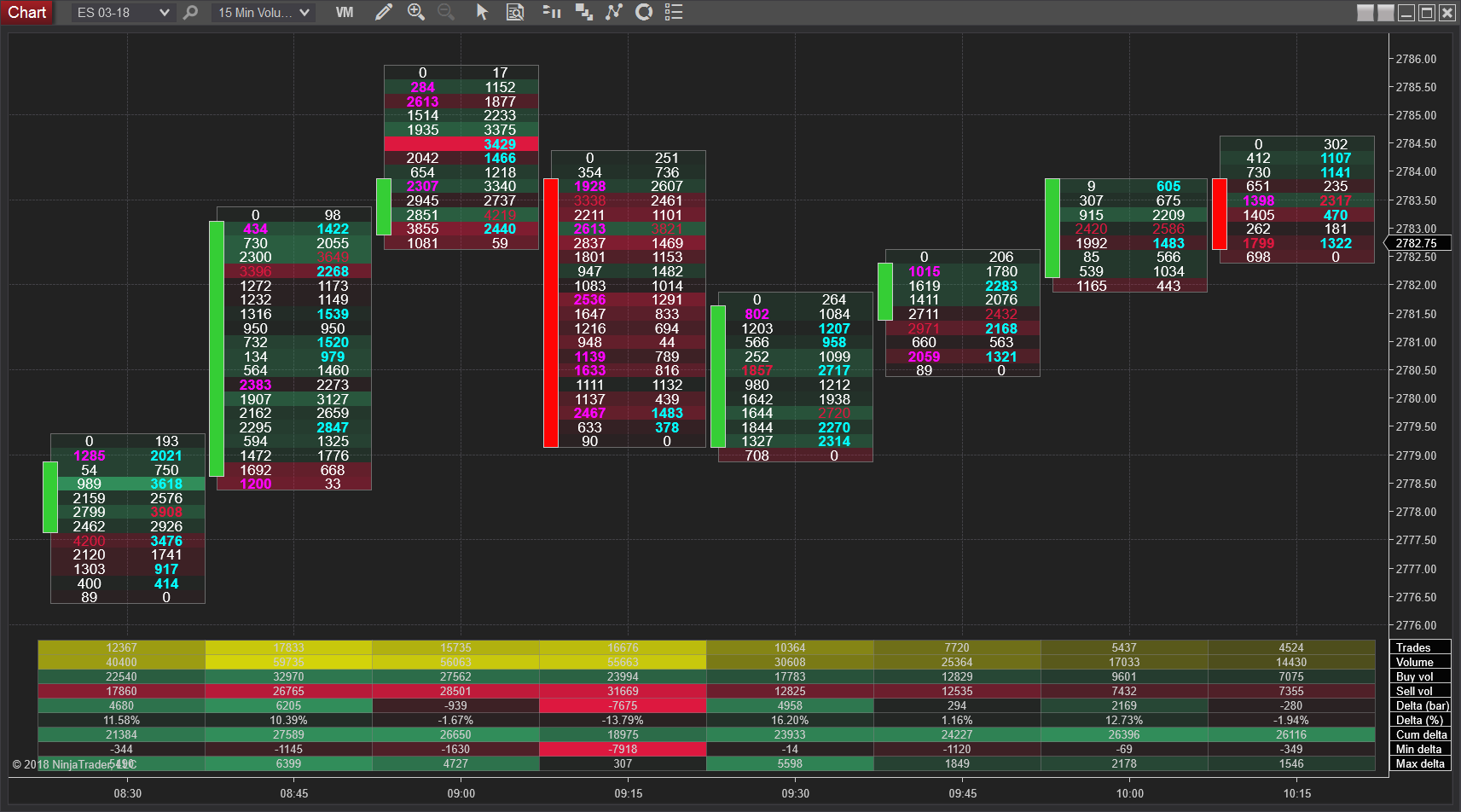

6. NakedMarkets

Image Source: naked-markets.com

Why it’s great for beginners: NakedMarkets is designed to offer a simplified yet powerful approach to backtesting, making it ideal for those who want to focus on strategy without getting bogged down by complicated tools.

- User-friendly interface: Its clean and intuitive design makes it easy for beginners to set up and run backtests without technical difficulties.

- Fast backtesting: NakedMarkets is optimized for speed, allowing you to run multiple backtests quickly and efficiently.

- Customizable templates: Beginners can use pre-built templates or customize their strategies with ease, no coding required.

- Realistic market simulation: It includes features like slippage and spread simulation, offering a more accurate view of how your strategy would perform in real-world conditions.

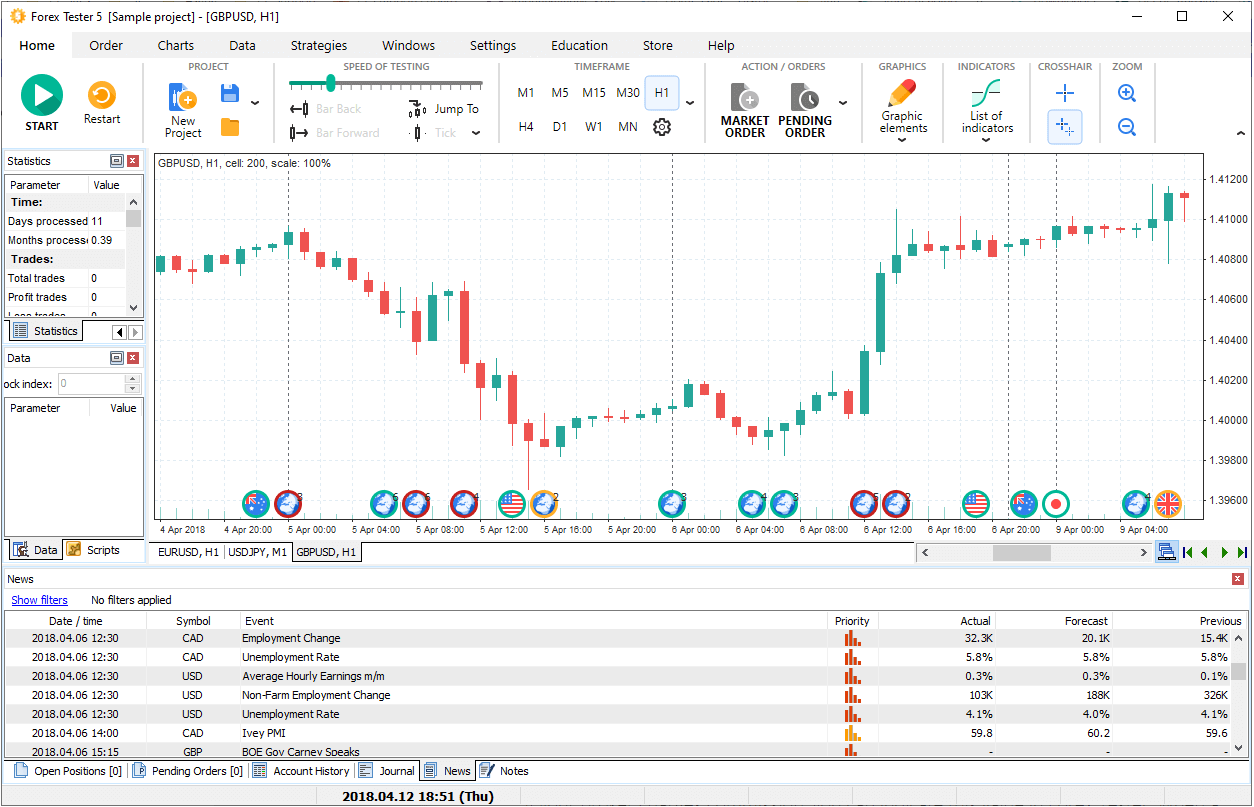

7. Forex Tester

Image Source: forextester.com/features

Why it’s great for beginners: Forex Tester is a specialized backtesting tool for forex traders, providing an easy-to-use interface with plenty of educational support.

- Forex-focused: This software is built specifically for forex traders, offering comprehensive tools to test strategies on currency pairs.

- Historical data: It provides access to years of forex market data, allowing you to test your strategy across different market environments.

- Practice mode: Beginners can use a simulation mode to practice trading in real-time using past data, improving their skills without risking money.

- Comprehensive tutorials: Forex Tester offers a library of guides, videos, and resources to help new traders get started with backtesting and live trading.

Conclusion

Backtesting is like your personal trading time machine, letting you see how your strategy would have performed before you risk real money. It’s not just for pros—whether you’re new to trading or have been in the game for a while, backtesting gives you the confidence to make decisions backed by data, not just instincts. Think of it as your safety net, allowing you to experiment, adjust, and refine your approach without facing the consequences of real-world trading.

What’s really exciting about backtesting is that it’s not a one-and-done process. Markets are always evolving, and your strategy should too. By regularly testing and tweaking your approach, you stay ahead of market shifts and adapt quickly when conditions change. You’re no longer just reacting—you’re actively preparing for what’s next, giving you an edge over traders who rely purely on guesswork.

In the end, trading successfully isn’t about being perfect—it’s about being prepared. With the right backtesting software, whether it’s TradingView, MetaTrader, or another platform, you’re giving yourself the tools to trade smarter, with confidence. So, test your strategies, learn from the data, and head into the markets knowing you’ve already done the groundwork. The future of your trading success starts with a single backtest.

Disclaimer: The information provided by Quant Matter in this article is intended for general informational purposes and does not reflect the company’s opinion. It is not intended as investment advice or a recommendation. Readers are strongly advised to conduct their own thorough research and consult with a qualified financial advisor before making any financial decisions.

Joshua Soriano

As an author, I bring clarity to the complex intersections of technology and finance. My focus is on unraveling the complexities of using data science and machine learning in the cryptocurrency market, aiming to make the principles of quantitative trading understandable for everyone. Through my writing, I invite readers to explore how cutting-edge technology can be applied to make informed decisions in the fast-paced world of crypto trading, simplifying advanced concepts into engaging and accessible narratives.

- Joshua Soriano#molongui-disabled-link

- Joshua Soriano#molongui-disabled-link

- Joshua Soriano#molongui-disabled-link

- Joshua Soriano#molongui-disabled-link